https://www.justice.gov/opa/pr/national-health-care-fraud-takedown-results-charges-against-over-412-individuals-responsible

Attorney General Jeff Sessions and Department of Health and Human Services (HHS) Secretary Tom Price, M.D., announced today the largest ever health care fraud enforcement action by the Medicare Fraud Strike Force, involving 412 charged defendants across 41 federal districts, including 115 doctors, nurses and other licensed medical professionals, for their alleged participation in health care fraud schemes involving approximately $1.3 billion in false billings. Of those charged, over 120 defendants, including doctors, were charged for their roles in prescribing and distributing opioids and other dangerous narcotics. Thirty state Medicaid Fraud Control Units also participated in today’s arrests. In addition, HHS has initiated suspension actions against 295 providers, including doctors, nurses and pharmacists.

Attorney General Sessions and Secretary Price were joined in the announcement by Acting Assistant Attorney General Kenneth A. Blanco of the Justice Department’s Criminal Division, Acting Director Andrew McCabe of the FBI, Acting Administrator Chuck Rosenberg of the Drug Enforcement Administration (DEA), Inspector General Daniel Levinson of the HHS Office of Inspector General (OIG), Chief Don Fort of IRS Criminal Investigation, Administrator Seema Verma of the Centers for Medicare and Medicaid Services (CMS), and Deputy Director Kelly P. Mayo of the Defense Criminal Investigative Service (DCIS).

Today’s enforcement actions were led and coordinated by the Criminal Division, Fraud Section’s Health Care Fraud Unit in conjunction with its Medicare Fraud Strike Force (MFSF) partners, a partnership between the Criminal Division, U.S. Attorney’s Offices, the FBI and HHS-OIG. In addition, the operation includes the participation of the DEA, DCIS, and State Medicaid Fraud Control Units.

The charges announced today aggressively target schemes billing Medicare, Medicaid, and TRICARE (a health insurance program for members and veterans of the armed forces and their families) for medically unnecessary prescription drugs and compounded medications that often were never even purchased and/or distributed to beneficiaries. The charges also involve individuals contributing to the opioid epidemic, with a particular focus on medical professionals involved in the unlawful distribution of opioids and other prescription narcotics, a particular focus for the Department. According to the CDC, approximately 91 Americans die every day of an opioid related overdose.

“Too many trusted medical professionals like doctors, nurses, and pharmacists have chosen to violate their oaths and put greed ahead of their patients,” said Attorney General Sessions. “Amazingly, some have made their practices into multimillion dollar criminal enterprises. They seem oblivious to the disastrous consequences of their greed. Their actions not only enrich themselves often at the expense of taxpayers but also feed addictions and cause addictions to start. The consequences are real: emergency rooms, jail cells, futures lost, and graveyards. While today is a historic day, the Department’s work is not finished. In fact, it is just beginning. We will continue to find, arrest, prosecute, convict, and incarcerate fraudsters and drug dealers wherever they are.”

“Healthcare fraud is not only a criminal act that costs billions of taxpayer dollars – it is an affront to all Americans who rely on our national healthcare programs for access to critical healthcare services and a violation of trust,” said Secretary Price. “The United States is home to the world’s best medical professionals, but their ability to provide affordable, high-quality care to their patients is jeopardized every time a criminal commits healthcare fraud. That is why this Administration is committed to bringing these criminals to justice, as President Trump demonstrated in his 2017 budget request calling for a new $70 million investment in the Health Care Fraud and Abuse Control Program. The historic results of this year’s national takedown represent significant progress toward protecting the integrity and sustainability of Medicare and Medicaid, which we will continue to build upon in the years to come.”

According to court documents, the defendants allegedly participated in schemes to submit claims to Medicare, Medicaid and TRICARE for treatments that were medically unnecessary and often never provided. In many cases, patient recruiters, beneficiaries and other co-conspirators were allegedly paid cash kickbacks in return for supplying beneficiary information to providers, so that the providers could then submit fraudulent bills to Medicare for services that were medically unnecessary or never performed. The number of medical professionals charged is particularly significant, because virtually every health care fraud scheme requires a corrupt medical professional to be involved in order for Medicare or Medicaid to pay the fraudulent claims. Aggressively pursuing corrupt medical professionals not only has a deterrent effect on other medical professionals, but also ensures that their licenses can no longer be used to bilk the system.

“This week, thanks to the work of dedicated investigators and analysts, we arrested once-trusted doctors, pharmacists and other medical professionals who were corrupted by greed,” said Acting Director McCabe. “The FBI is committed to working with our partners on the front lines of the fight against heath care fraud to stop those who steal from the government and deceive the American public.”

“Health care fraud is a reprehensible crime. It not only represents a theft from taxpayers who fund these vital programs, but impacts the millions of Americans who rely on Medicare and Medicaid,” said Inspector General Levinson. “In the worst fraud cases, greed overpowers care, putting patients’ health at risk. OIG will continue to play a vital leadership role in the Medicare Fraud Strike Force to track down those who abuse important federal health care programs.”

“Our enforcement actions underscore the commitment of the Defense Criminal Investigative Service and our partners to vigorously investigate fraud perpetrated against the DoD’s TRICARE Program. We will continue to relentlessly investigate health care fraud, ensure the taxpayers’ health care dollars are properly spent, and endeavor to guarantee our service members, military retirees, and their dependents receive the high standard of care they deserve,” advised Deputy Director Mayo.

“Last year, an estimated 59,000 Americans died from a drug overdose, many linked to the misuse of prescription drugs. This is, quite simply, an epidemic,” said Acting Administrator Rosenberg. “There is a great responsibility that goes along with handling controlled prescription drugs, and DEA and its partners remain absolutely committed to fighting the opioid epidemic using all the tools at our disposal.”

“Every defendant in today’s announcement shares one common trait – greed,” said Chief Fort. “The desire for money and material items drove these individuals to perpetrate crimes against our healthcare system and prey upon many of the vulnerable in our society. Thanks to the financial expertise and diligence of IRS-CI special agents, who worked side-by-side with other federal, state and local law enforcement officers to uncover these schemes, these criminals are off the street and will now face the consequences of their actions.”

The Medicare Fraud Strike Force operations are part of a joint initiative between the Department of Justice and HHS to focus their efforts to prevent and deter fraud and enforce current anti-fraud laws around the country. The Medicare Fraud Strike Force operates in nine locations nationwide. Since its inception in March 2007, the Medicare Fraud Strike Force has charged over 3500 defendants who collectively have falsely billed the Medicare program for over $12.5 billion.

*********

For the Strike Force locations, in the Southern District of Florida, a total of 77 defendants were charged with offenses relating to their participation in various fraud schemes involving over $141 million in false billings for services including home health care, mental health services and pharmacy fraud. In one case, the owner and operator of a purported addiction treatment center and home for recovering addicts and one other individual were charged in a scheme involving the submission of over $58 million in fraudulent medical insurance claims for purported drug treatment services. The allegations include actively recruiting addicted patients to move to South Florida so that the co-conspirators could bill insurance companies for fraudulent treatment and testing, in return for which, the co-conspirators offered kickbacks to patients in the form of gift cards, free airline travel, trips to casinos and strip clubs, and drugs.

In the Eastern District of Michigan, 32 defendants face charges for their alleged roles in fraud, kickback, money laundering and drug diversion schemes involving approximately $218 million in false claims for services that were medically unnecessary or never rendered. In one case, nine defendants, including six physicians, were charged with prescribing medically unnecessary controlled substances, some of which were sold on the street, and billing Medicare for $164 million in facet joint injections, drug testing, and other procedures that were medically unnecessary and/or not provided.

In the Southern District of Texas, 26 individuals were charged in cases involving over $66 million in alleged fraud. Among these defendants are a physician and a clinic owner who were indicted on one count of conspiracy to distribute and dispense controlled substances and three substantive counts of distribution of controlled substances in connection with a purported pain management clinic that is alleged to have been the highest prescribing hydrocodone clinic in Houston, where approximately 60-70 people were seen daily, and were issued medically unnecessary prescriptions for hydrocodone in exchange for approximately $300 cash per visit.

In the Central District of California, 17 defendants were charged for their roles in schemes to defraud Medicare out of approximately $147 million. Two of these defendants were indicted for their alleged involvement in a $41.5 million scheme to defraud Medicare and a private insurer. This was purportedly done by submitting fraudulent claims, and receiving payments for, prescription drugs that were not filled by the pharmacy nor given to patients.

In the Northern District of Illinois, 15 individuals were charged in cases related to six different schemes concerning home health care services and physical therapy fraud, kickbacks, and mail and wire fraud. These schemes involved allegedly over $12.7 million in fraudulent billing. One case allegedly involved $7 million in fraudulent billing to Medicare for home health services that were not necessary nor rendered.

In the Middle District of Florida, 10 individuals were charged with participating in a variety of schemes involving almost $14 million in fraudulent billing. In one case, three defendants were charged in a $4 million scheme to defraud the TRICARE program. In that case, it is alleged that a defendant falsely represented himself to be a retired Lieutenant Commander of the United States Navy Submarine Service. It is alleged that he did so in order to gain the trust and personal identifying information from TRICARE beneficiaries, many of whom were members and veterans of the armed forces, for use in the scheme.

In the Eastern District of New York, ten individuals were charged with participating in a variety of schemes including kickbacks, services not rendered, and money laundering involving over $151 million in fraudulent billings to Medicare and Medicaid. Approximately $100 million of those fraudulent billings were allegedly part of a scheme in which five health care professionals paid illegal kickbacks in exchange for patient referrals to their own clinics.

In the Southern Louisiana Strike Force, operating in the Middle and Eastern Districts of Louisiana as well as the Southern District of Mississippi, seven defendants were charged in connection with health care fraud, wire fraud, and kickback schemes involving more than $207 million in fraudulent billing. One case involved a pharmacist who was charged with submitting and causing the submission of $192 million in false and fraudulent claims to TRICARE and other health care benefit programs for dispensing compounded medications that were not medically necessary and often based on prescriptions induced by illegal kickback payments.

*********

In addition to the Strike Force locations, today’s enforcement actions include cases and investigations brought by an additional 31 U.S. Attorney’s Offices, including the execution of search warrants in investigations conducted by the Eastern District of California and the Northern District of Ohio.

In the Northern and Southern Districts of Alabama, three defendants were charged for their roles in two health care fraud schemes involving pharmacy fraud and drug diversion.

In the Eastern District of Arkansas, 24 defendants were charged for their roles in three drug diversion schemes that were all investigated by the DEA.

In the Northern and Southern Districts of California, four defendants, including a physician, were charged for their roles in a drug diversion scheme and a health care fraud scheme involving kickbacks.

In the District of Connecticut, three defendants were charged in two health care fraud schemes, including a scheme involving two physicians who fraudulently billed Medicaid for services that were not rendered and for the provision of oxycodone with knowledge that the prescriptions were not medically necessary.

In the Northern and Southern Districts of Georgia, three defendants were charged in two health care fraud schemes involving nearly $1.5 million in fraudulent billing.

In the Southern District of Illinois, five defendants were charged in five separate schemes to defraud the Medicaid program.

In the Northern and Southern Districts of Indiana, at least five defendants were charged in various health care fraud schemes related to the unlawful distribution and dispensing of controlled substances, kickbacks, and services not rendered.

In the Southern District of Iowa, five defendants were charged in two schemes involving the distribution of opioids.

In the Western District of Kentucky, 11 defendants were charged with defrauding the Medicaid program. In one case, four defendants, including three medical professionals, were charged with distributing controlled substances and fraudulently billing the Medicaid program.

In the District of Maine, an office manager was charged with embezzling funds from a medical office.

In the Eastern and Western Districts of Missouri, 16 defendants were charged in schemes involving over $16 million in claims, including 10 defendants charged as part of a scheme involving fraudulent lab testing.

In the District of Nebraska, a dentist was charged with defrauding the Medicaid program.

In the District of Nevada, two defendants, including a physician, were charged in a scheme involving false hospice claims.

In the Northern, Southern, and Western Districts of New York, five defendants, including two physicians and two pharmacists, were charged in schemes involving drug diversion and pharmacy fraud.

In the Southern District of Ohio, five defendants, including four physicians, were charged in connection with schemes involving $12 million in claims to the Medicaid program.

In the District of Puerto Rico, 13 defendants, including three physicians and two pharmacists, were charged in four schemes involving drug diversion, Medicaid fraud, and the theft of funds from a health care program.

In the Eastern District of Tennessee, three defendants were charged in a scheme involving fraudulent billings and the distribution of opioids.

In the Eastern, Northern, and Western Districts of Texas, nine defendants were charged in schemes involving over $42 million in fraudulent billing, including a scheme involving false claims for compounded medications.

In the District of Utah, a nurse practitioner was charged in connection with fraudulently obtaining a controlled substance, tampering with a consumer product, and infecting over seven individuals with Hepatitis C.

In the Eastern District of Virginia, a defendant was charged in connection with a scheme involving identify theft and fraudulent billings to the Medicaid program.

In addition, in the states of Arizona, Arkansas, California, Delaware, Illinois, Iowa, Louisiana, Massachusetts, Michigan, Minnesota, Mississippi, New York, Oklahoma, Pennsylvania, Rhode Island, South Dakota, Texas, Utah, Vermont, Washington and Wisconsin, 96 defendants have been charged in criminal and civil actions with defrauding the Medicaid program out of over $31 million. These cases were investigated by each state’s respective Medicaid Fraud Control Units. In addition, the Medicaid Fraud Control Units of the states of Alabama, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Missouri, Nebraska, New York, North Carolina, Ohio, Texas, and Utah participated in the investigation of many of the federal cases discussed above.

The cases announced today are being prosecuted and investigated by U.S. Attorney’s Offices nationwide, along with Medicare Fraud Strike Force teams from the Criminal Division’s Fraud Section and from the U.S. Attorney’s Offices of the Southern District of Florida, Eastern District of Michigan, Eastern District of New York, Southern District of Texas, Central District of California, Eastern District of Louisiana, Northern District of Texas, Northern District of Illinois and the Middle District of Florida; and agents from the FBI, HHS-OIG, Drug Enforcement Administration, DCIS and state Medicaid Fraud Control Units.

A complaint, information, or indictment is merely an allegation, and all defendants are presumed innocent unless and until proven guilty.

Additional documents related to this announcement will shortly be available here: https://www.justice.gov/opa/documents-and-resources-july-13-2017.

This operation also highlights the great work being done by the Department of Justice’s Civil Division. In the past fiscal year, the Department of Justice, including the Civil Division, has collectively won or negotiated over $2.5 billion in judgments and settlements related to matters alleging health care fraud.

From Joanne:

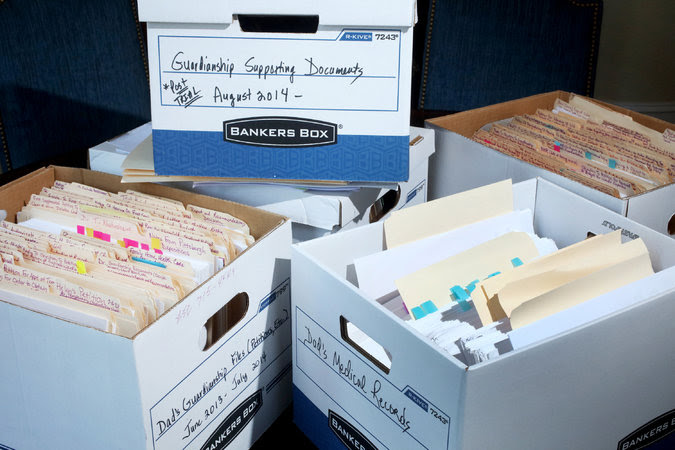

Walk into any nursing home and you will see patients in wheelchairs drugged and falling over in wheelchairs, never to see the light of day again. 90% of them (or more) just want to go home or live with their friends and relatives but the courts say no. That, my friend, is the worst fraud on the public. People that want to go home, are chained to wheel chairs and beds with illegal chemical restraints, and then drugged to death. Opiods and other dangerous drugs are prescribed wildly by drive thru doctors in large quantities easy for others to swipe and for massive fraud to occur.

While other countries put their aged and disableds in small communities with home health care and prescribe vitamins, diet, yoga and light exercise (which are known to work), we drug ’em and put them in facilities where no one wants to be and they amount to nothing but slums and ghettos for the aged and disabled.

And if anyone, I mean anyone dares to complain publicly about this system and the court system that supports it, you WILL be called a liar, your blog will be called lies by the ARDC and “like crying fire in a crowded theater” and you will receive hefty discipline and lose your license Not just attorneys like myself and Ken Ditkowsky, but nurses have complained to me about being blackballed for reporting elder/disabled abuse, and even social workers in hospital settings.

The greed and corruption of our health care system is out of control.

Prayers for those who have been murdered in probate abusive guardianships and their families: Mary Sykes, Lydia Tyler, Rose Drabik, Helen Rector, Allen Frake, Jay Brouckmeersch, Mary Jane Teichert, and those at risk: Iwanna Lahoody and Amelia Sallas.

From Ken Ditkowsky:

Unfortunately the very same crap has been going on in Illinois, Florida, New York etc.

I am grateful for small favors!

Guardianships were like receiverships. When I first passed the bar in the course of my practice I was involved in some foreclosures and disputed cases in which it was appropriate to appoint a receiver so as to protect the interests of all the litigants. It did not take long to discover that the receiver was a political lackey whose tenure was a serious depreciation problem for all the litigants. If the gross rental were x dollars, expect that x plus y dollars would be spent on rather obvious substandard maintenance upkeep and repairs. Insurance would be purchased from a politically active firm at prices the exceed 100% of the cost of a STate Farm policy, and the receivers legal costs were sufficient to support an army of lawyers. In simple words it was the same scam that you and so many experienced in the guardianship for profit scenario. (Of course the judge receive a kickback! – it took real persuasion on the part of all the lawyers to prevent that appointment of a receiver and the Judge was never certain that an impartial receiver would not be better than that owners themselves by agreement doing the management or their hiring a multi-billion dollar management company. The incompetent receiver ******

As I see it the only distinction between today and then is the fact that we are seeing a minute enforcement effort right now.